Everyone needs insurance; however, your insurance needs to change over time. You may need different insurance policies when you have children, start a business, buy a home, or get a new vehicle. Once you’re an adult, you’ll eventually need a health insurance policy because your parent’s plan won’t cover you.

Choosing health insurance can be daunting. Although Australians aren’t obligated to pay for private health insurance, you may enjoy tax breaks if you have private health coverage. Read on to discover how to identify the best health insurance companies in Australia and the types of coverage offered by each insurance company.

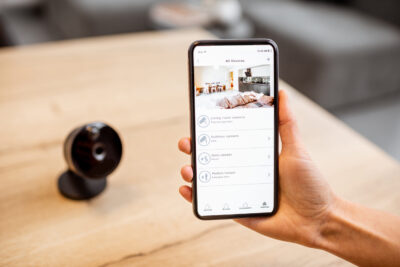

You can find health insurance options online.

A health insurance comparison tool makes it possible to identify health insurance companies with your smartphone or an internet connection and computer. Pull up the tool and enter the information it requests, starting with your ZIP code and the type of coverage you need. For example, you may be looking for an insurance policy for yourself or need one that covers you and your partner. Perhaps you have children to be added to your plan. Clarifying your needs helps the tool prioritize insurance companies offering the coverage you need.

Finding the best health insurance also involves indicating whether you currently have coverage. If you’re looking for insurance for you and a partner, the tool will also ask if your partner has coverage. Those who don’t have coverage are asked if there’s a specific reason they’re searching for health insurance, such as having a baby, looking for a tax credit, or simply comparing options. The tool also asks for personal information, including your and your partner’s dates of birth and your typical annual income. Once the tool has all the required information, it presents a list of insurance companies with insurance plans suited to your needs. You can use the details provided to compare insurance companies and sign up for insurance.

There are several factors to consider when choosing the best health insurance company.

While you’re using the insurance comparison tool, it will prompt you to select between your coverage options. You can choose between hospital only, extras only, or hospital and extras. Australia’s Medicare program is a universal health care system that ensures all Australians have access to primary health care. Medicare covers treatment in public hospitals. However, those who want to use private hospitals must have private health insurance covering hospital stays. There are four tiers of hospital care plans, including a basic plan that eliminates your medical levy surcharge (MLS) and lifetime health cover (LHC) fees. Higher tiers cover additional services, including joint replacements, dental surgery, and maternity costs.

Extras cover various medical services that Medicare doesn’t include, such as optical care, dental care, and physiotherapy. Suppose you have a chronic condition requiring ongoing physiotherapy. Obtaining a health insurance extras coverage plan is an affordable way to ensure you can access the health care treatment you need. Some extras coverage options only include a handful of additional treatment options. Still, extensive extras coverage plans include extensive health care services such as hearing aids, blood glucose monitors, speech therapy, and medications not included in the pharmaceutical benefits scheme (PBS) program. The PBS program’s a government-run program designed to ensure Australians have access to affordable prescription medications.

Since the health care needs of individuals vary widely, there’s no single insurance company that offers the best health care plan for all consumers. Your health, your family’s needs, and your income are crucial factors determining which insurance plan’s best for you. This is why you must take the time to clarify your needs and review all plan options before choosing a health insurance provider.

Australia’s best health insurance companies provide the health coverage you need. The best plan for you will also fit within your budget, ensuring you can afford coverage.